The question of "how much is 1 dollar to 1 naira" is one that captures the attention of many people, whether they are living in Nigeria, have family there, or are simply interested in global economics. This particular exchange rate is, you know, a very dynamic figure, constantly moving and changing based on a whole lot of different forces. It's not just a simple number you can look up once and forget; it reflects a country's economic health and its connection to the wider world. Figuring out this value, really, means understanding a good deal about currency and markets.

For anyone looking to send money home, do business, or perhaps even travel, knowing the current value of the U.S. dollar against the Nigerian naira is, actually, pretty important. This value dictates, in a way, the purchasing power of your money and can truly influence everyday decisions. It's a topic that comes up quite often in conversations, particularly when folks are thinking about their finances or the cost of things.

So, we're going to explore what makes this exchange rate move, why it's so important to keep an eye on it, and how you can, in some respects, stay informed. We'll talk about the different ways this value shows up and what it all means for you. It's about getting a clearer picture of this financial relationship.

Table of Contents

- Understanding the Dollar to Naira Exchange

- Forces That Shape the Exchange Rate

- Different Exchange Rate Expressions

- Why Knowing the Rate Matters a Great Deal

- Keeping Up with the Current Value

- The Impact on Daily Living

- A Look at the Past: General Trends

- Frequently Asked Questions About the Exchange Rate

Understanding the Dollar to Naira Exchange

When people ask "how much is 1 dollar to 1 naira," they are, actually, trying to figure out the conversion rate between these two distinct currencies. It's a way of expressing how many units of the Nigerian naira you would receive for one unit of the United States dollar. This ratio is, you know, a key indicator of economic conditions and trade relationships between nations.

The value itself is, in a way, a reflection of how strong or weak each currency is perceived to be at a given moment. A higher number of naira for one dollar means the naira has a bit less purchasing power compared to the dollar. It's like comparing the size of two different baskets of goods that each currency can buy, and that can change a great deal.

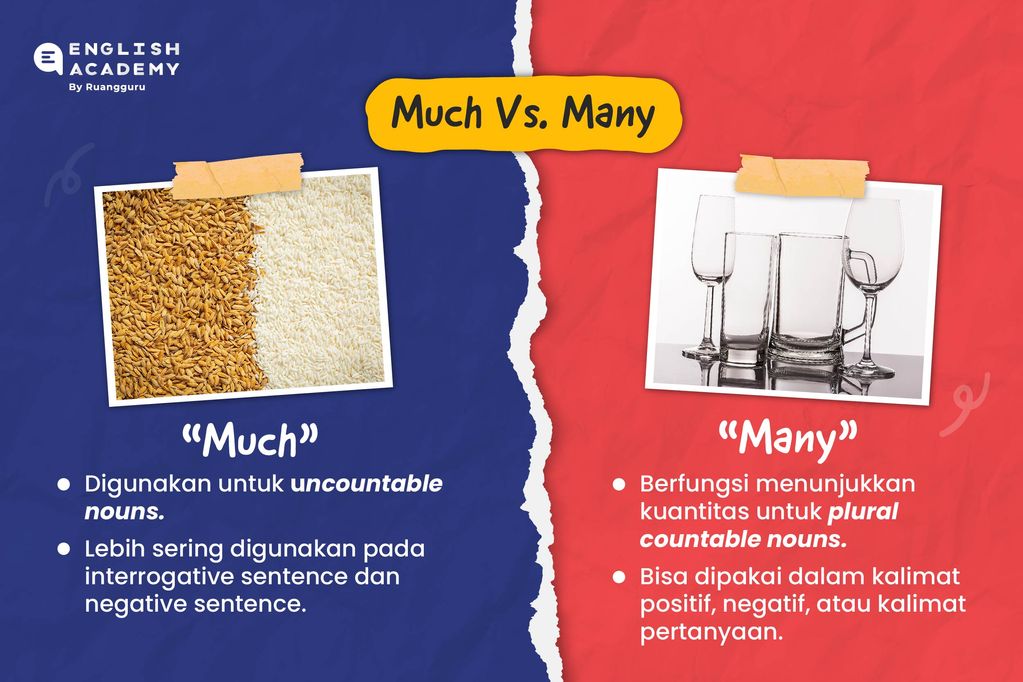

This idea of "much" here really gets to the heart of it, referring to the *quantity* or *amount* of naira you get. Just how *much* naira do you receive for that single dollar? The answer to that question can, so, shift quite a bit, making it a topic of constant discussion and observation for many.

Forces That Shape the Exchange Rate

Several significant forces are constantly at play, influencing the value of the U.S. dollar against the Nigerian naira. These forces, you know, interact in complex ways, causing the rate to fluctuate, sometimes even quite dramatically. Understanding these elements helps us grasp why the rate is what it is, and why it tends to be a bit unpredictable.

Supply and Demand Dynamics

At its very core, the exchange rate is, basically, determined by the supply and demand for both currencies. If there's a very high demand for dollars in Nigeria, perhaps because many businesses need to import goods, the dollar's value against the naira will, in some respects, tend to go up. Conversely, if there are many dollars available and fewer people need them, its value might, perhaps, soften a little.

This push and pull of supply and demand is, really, a fundamental principle in economics, and it applies very directly to currency markets. It's about how *much* people want a currency versus how *much* of it is available. A big imbalance can cause significant shifts, you know, quite quickly.

Oil Prices and Their Influence

Nigeria, as a major oil-producing nation, sees its economy, and thus its currency, heavily tied to global oil prices. When oil prices are, you know, quite high, Nigeria earns more foreign currency, particularly dollars, from its exports. This increases the supply of dollars in the economy, which can, in a way, help stabilize or even strengthen the naira.

On the other hand, if oil prices drop, the country earns less foreign exchange, creating a scarcity of dollars. This scarcity can, typically, put downward pressure on the naira, making the dollar worth, you know, a bit more naira. It's a very direct link that can cause a lot of movement.

Government Decisions and Policies

The actions and policies of the government and the central bank also play, actually, a huge part in shaping the exchange rate. Decisions regarding interest rates, foreign exchange regulations, and trade policies can, in some respects, directly impact the availability and demand for foreign currency. For example, policies aimed at encouraging local production might, in a way, reduce the demand for imported goods and, consequently, for dollars.

These policy shifts can, sometimes, lead to significant changes in how *much* naira you get for a dollar. They are, you know, deliberate efforts to guide the economy, and currency values are a key outcome of those efforts. It's a very powerful tool in their hands.

Inflation and Economic Stability

Inflation, which is the general rise in prices for goods and services, also has, you know, a considerable impact on currency value. If a country experiences high inflation, its currency tends to lose purchasing power, both domestically and internationally. This means that, over time, you would need *much* more of that currency to buy the same amount of goods, or the same amount of a foreign currency.

A stable economy, with manageable inflation, tends to have a more stable and, perhaps, stronger currency. Investors are, basically, more likely to put their money into a country that shows economic steadiness, which increases demand for its currency. It's a fundamental aspect of a currency's health, really.

Global Economic Happenings

Events on the global stage can, you know, also send ripples through currency markets, affecting the dollar to naira rate. Things like global recessions, shifts in international trade agreements, or even major geopolitical events can, arguably, influence investor confidence and capital flows. If there's a lot of uncertainty in the world, people often look for safer investments, and the U.S. dollar is, typically, seen as a safe haven currency.

This increased demand for the dollar in times of global stress can, of course, make it worth *much* more naira. It's a reminder that no economy exists in isolation, and external forces can, really, have a profound effect.

Different Exchange Rate Expressions

When you ask "how much is 1 dollar to 1 naira," you might, you know, encounter different answers depending on where you look. This is because there isn't just one single, universal rate that applies everywhere. There are, in fact, different channels through which currency exchanges happen, and each might present a slightly different value.

The Official Rate

The official exchange rate is, basically, the rate set or recognized by the country's central bank. This is the rate that is, typically, used for official government transactions and often serves as a benchmark for financial institutions. It's the rate you might see quoted in official reports or by major banks for certain types of transactions.

However, the actual availability of foreign currency at this official rate can, sometimes, be limited, especially for everyday individuals or smaller businesses. This can create a situation where the demand for dollars, perhaps, outweighs the supply at this specific rate. It's a regulated figure, you know, often aimed at stability.

The Parallel Market Rate

Alongside the official rate, there is, also, often a parallel or black market rate. This rate emerges from the informal currency exchange market, where individuals and businesses trade foreign currency outside of official channels. The parallel market rate is, usually, driven purely by the forces of supply and demand, without direct intervention from the central bank.

Because of this, the parallel market rate can, frequently, be quite different from the official rate, sometimes showing a significantly higher amount of naira for one dollar. This difference highlights, in a way, the scarcity of foreign currency in the official channels and the willingness of people to pay *much* more to get the dollars they need. It's a reflection of real-world demand, you know, quite directly.

Why Knowing the Rate Matters a Great Deal

Understanding "how much is 1 dollar to 1 naira" is not just an academic exercise; it has, in fact, very real implications for many people's lives and livelihoods. The fluctuations in this rate can, basically, affect everything from daily purchases to large-scale business operations. It's a figure that, truly, has a great deal of impact.

For Individuals and Families

For individuals, especially those receiving remittances from abroad, the exchange rate directly determines how *much* naira their dollar-denominated funds will convert into. A favorable rate means more local currency, which can, of course, go a longer way in covering expenses like food, rent, or school fees. A less favorable rate, conversely, means less purchasing power, and that can be a challenge.

Similarly, for those planning to travel abroad or pay for international services, a higher dollar value means they will need, you know, a bit more naira to acquire the necessary foreign currency. It affects the cost of living, in a way, for many households, making it a very personal concern.

For Businesses and Trade

Businesses involved in international trade are, truly, very sensitive to changes in the dollar to naira rate. Importers, for instance, need dollars to purchase goods from other countries. If the dollar becomes worth *much* more naira, their import costs rise, which can, typically, lead to higher prices for consumers. This can, in some respects, make imported goods less affordable.

Exporters, on the other hand, might benefit from a weaker naira, as their dollar earnings would convert into *much* more local currency. This can, you know, make their products more competitive on the global market. The rate is, basically, a very important factor in their profitability and strategic planning.

For Travel and Tourism

For tourists visiting Nigeria, the dollar to naira exchange rate influences how *much* their foreign currency is worth in local spending power. A strong dollar means they can, actually, get a lot more naira for their money, making their trip potentially more affordable and enjoyable. This can, in a way, boost the tourism sector.

Conversely, for Nigerians traveling abroad, a weaker naira means their travel expenses in dollar-denominated countries will be, you know, a bit higher. It impacts the feasibility and cost of international travel, making the rate a key consideration for anyone planning a trip outside the country.

Keeping Up with the Current Value

Given that the exchange rate is, you know, constantly shifting, staying informed about the current value of 1 dollar to 1 naira is, really, quite important. Relying on outdated information can, actually, lead to financial disadvantages, especially for significant transactions. There are, basically, several reliable sources you can check to get the most up-to-date figures.

Reputable financial news outlets, for example, often provide daily updates on exchange rates. Websites and apps specializing in currency conversion are, also, very useful tools, offering real-time data. It's always a good idea to cross-reference information from a few different sources to get a comprehensive picture. You can learn more about currency exchange rates on our site, and also find helpful information on this page about economic indicators.

The central bank's official website is, typically, the definitive source for the official rate. For the parallel market rate, you might need to consult specialized financial news platforms that track these informal values. Being aware of both rates helps you understand the full picture of the currency landscape, which is, you know, pretty helpful.

Checking these sources regularly, especially before making any transactions involving foreign currency, is, actually, a sensible habit. It helps you make more informed decisions and ensures you are getting a fair deal. It's about being prepared, you know, for the day's financial realities.

The Impact on Daily Living

The fluctuations in how much 1 dollar is to 1 naira truly affect the daily lives of people in Nigeria in a very direct way. When the naira weakens, for instance, the cost of imported goods, like electronics, cars, and even some food items, tends to rise. This is because businesses need, you know, more naira to acquire the dollars required to purchase these items from abroad.

This increase in prices can, basically, reduce the purchasing power of average incomes, making everyday essentials more expensive. It means that, in some respects, your money doesn't go as far as it used to, which can be a real challenge for household budgets. It's a very tangible effect that people feel, actually, quite keenly.

Conversely, a stronger naira could, perhaps, lead to a decrease in the cost of imported goods, making them more affordable. However, such movements are, typically, complex and influenced by many factors. The rate's movement can, truly, shape the economic atmosphere and consumer spending habits in a very significant way. It's a constant consideration for many.

A Look at the Past: General Trends

Looking back, the value of the U.S. dollar against the Nigerian naira has, actually, experienced quite a bit of change over the years. It's not a static relationship but rather one that has, you know, evolved with economic shifts, global events, and policy decisions. In the early 2000s, for example, the relationship between the two currencies was, perhaps, different than what we see today.

Over time, the amount of naira you could get for one dollar has, in fact, varied quite a bit, reflecting periods of economic growth, challenges, and adjustments in national policy. These historical trends show that the rate is, basically, never fixed and is always subject to the dynamic forces of the market and wider economic conditions. It's a story of constant movement, you know, quite literally.

Understanding these general patterns helps to put the current situation into perspective, even without specific numbers. It highlights the fact that currency values are, truly, a reflection of ongoing economic narratives and external influences. This historical context gives us a sense of the volatility that can, sometimes, characterize the exchange rate, making it a very interesting area to watch.

Frequently Asked Questions About the Exchange Rate

People often have many questions about "how much is 1 dollar to 1 naira" and the forces behind it. Here are some common inquiries:

What makes the dollar to naira rate change so often?

The rate changes, you know, quite frequently because it's influenced by a mix of things like how much oil costs globally, what the government decides to do with money, how much stuff people want to buy from other countries, and how strong the economy feels. These elements are, basically, always moving and reacting to each other, which makes the rate shift.

Is there a single, fixed rate for 1 dollar to 1 naira?

No, there isn't, actually, just one single, fixed rate. You'll find, in some respects, an official rate that the central bank sets, and then there's also a parallel market rate, which is what people use in less formal exchanges. These two rates can, you know, be quite different from each other, depending on various economic pressures and the availability of foreign currency.

How does the dollar to naira rate affect daily purchases in Nigeria?

The rate affects daily purchases a great deal, especially for things that come from other countries. If the dollar gets stronger against the naira, then imported goods, like electronics or certain foods, become, you know, more expensive in naira. This means your money might not buy, perhaps, as much as it used to, which can impact your budget.

Staying informed about the dollar to naira exchange rate is, truly, a very important step for anyone with a connection to Nigeria's economy. While the exact numerical value of "how much is 1 dollar to 1 naira" is, you know, always in motion, understanding the forces that drive these changes empowers you to make better financial decisions. Keep an eye on reliable sources, and you'll be better prepared for whatever the market brings.